Teacher Salary Stories: A Michigan Instructional Coach Earning $78,000 in 2024

"I do not wish to return to the classroom, ever."

The 7 Biggest Mistakes I Made My First Year of Teaching (and What I Wish I’d Known!)

Spoiler alert: None of them were the mistakes I thought I was making.

Grades:

Elementary School

Too Many Teachers Are Getting Hit, Kicked, and Punched by Students

What to do when students get physical.

Teachers Say This Is the #1 Best Piece of Advice for Nailing an Observation

Get evaluated on actual teaching instead of your and your students' nerves.

Help! I Gave My Students an Open-Book Test and They Still Failed

I've been teaching for 17 years and have never had this many students failing.

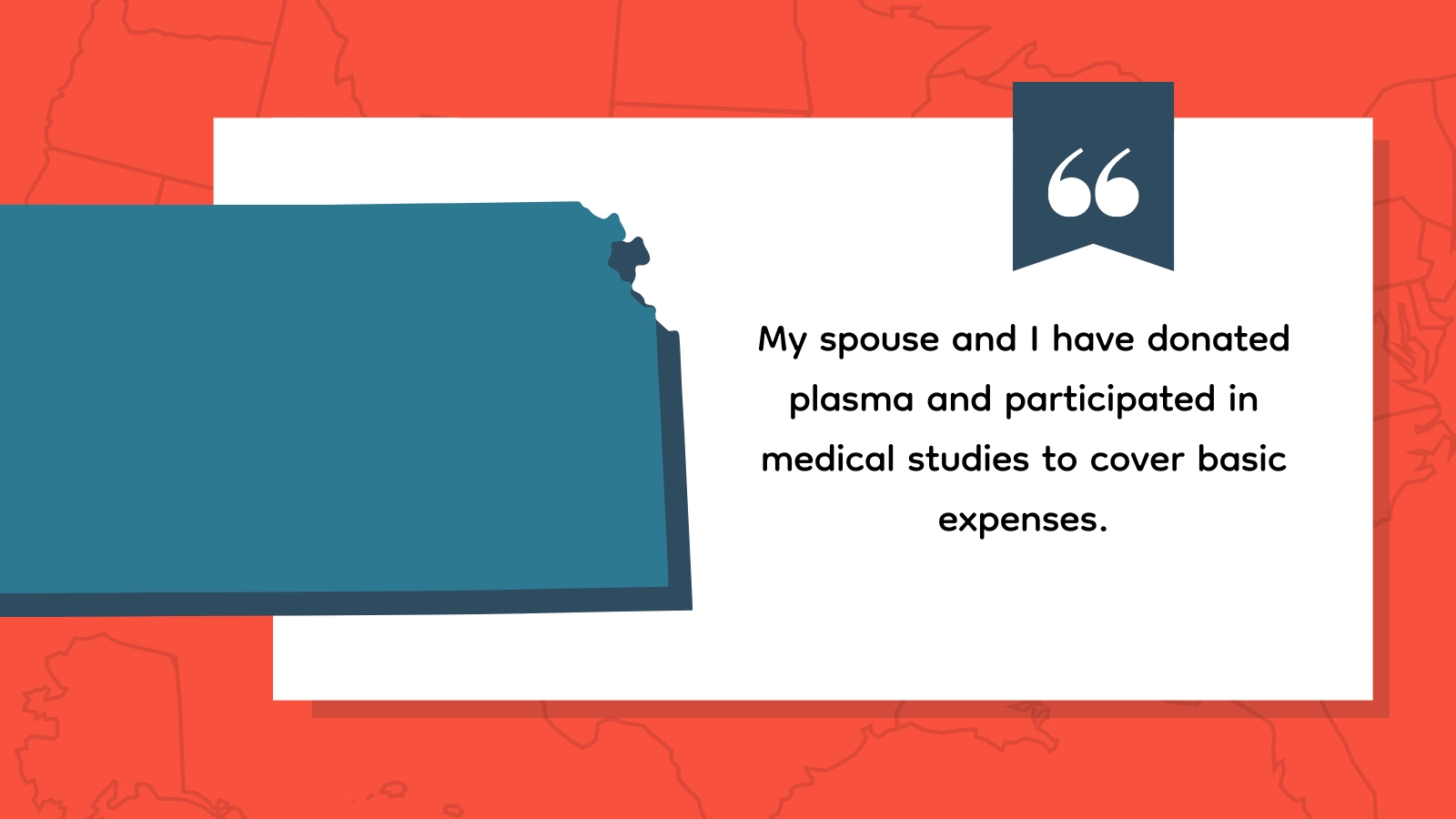

Teacher Salary Stories: A Kansas Elementary Teacher Earning $55,000 in 2024

"I plan to stay in education only because my degree is not transferable to anything other than childcare. I cannot afford more education."

Help! My Students Won’t Stop Making Inappropriate Noises

"Last year it was moaning. This year it's something new."

Teacher Salary Stories: A Northern Virginia Librarian Earning $95,100 in 2024

"People lament the difficulty schools face in hiring and retaining teachers, yet balk at the notion of higher taxes needed to pay their salaries."

Michigan Teacher Certification: Advice From a Real Teacher

So you want to teach in Michigan? We've got you.

Help! I Got in Trouble for Making My High School Students Learn the 50 States

A group of parents sent emails calling me “sadistic,” “demeaning,” and “petty.”