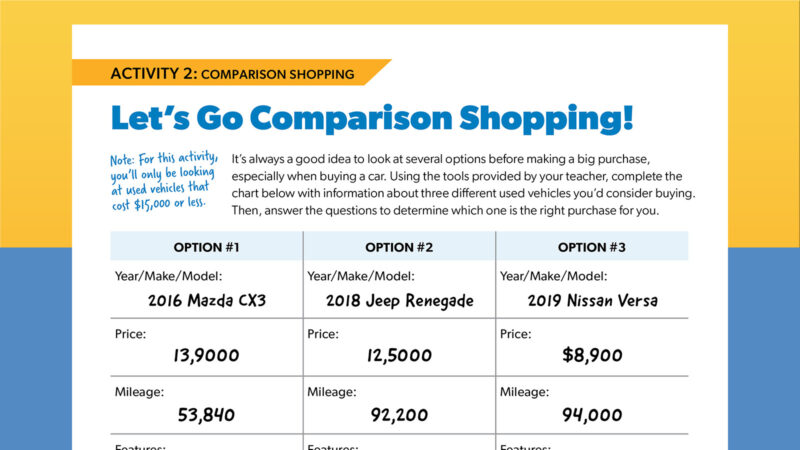

Many of our students daydream about cars they’d like to buy one day. So, how can we take students from daydreaming to making an informed financial decision and reaching their goal? Check out the Ticket to Drive: Your Path to Car Ownership lesson bundle.

Four different activities take your students from brainstorming their dream car to researching what cars truly cost, to creating a realistic budget to purchase their first car in cash. A reflection activity ties up the experience and provides a perfect opportunity for students to share their learning with each other. Your students will love being able to look at real cars currently available for purchase and seeing what it would take for them to actually buy one on their own.

Lessons included:

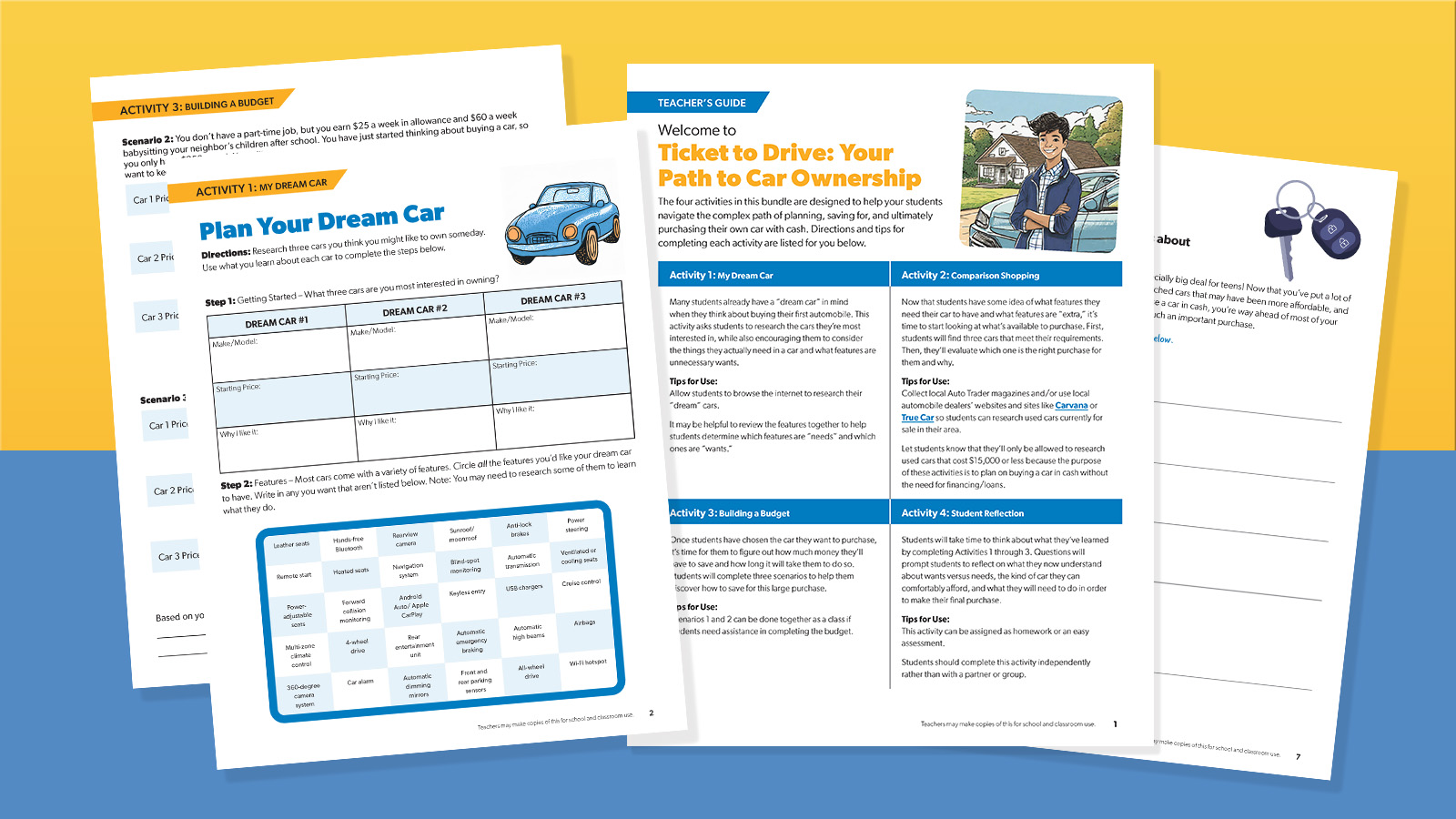

Activity 1: My Dream Car

Many students already have a “dream car” in mind when they think about buying their first automobile. This activity asks students to research the cars they’re most interested in, while also encouraging them to consider the features they actually need in a car and which features are unnecessary “wants.”

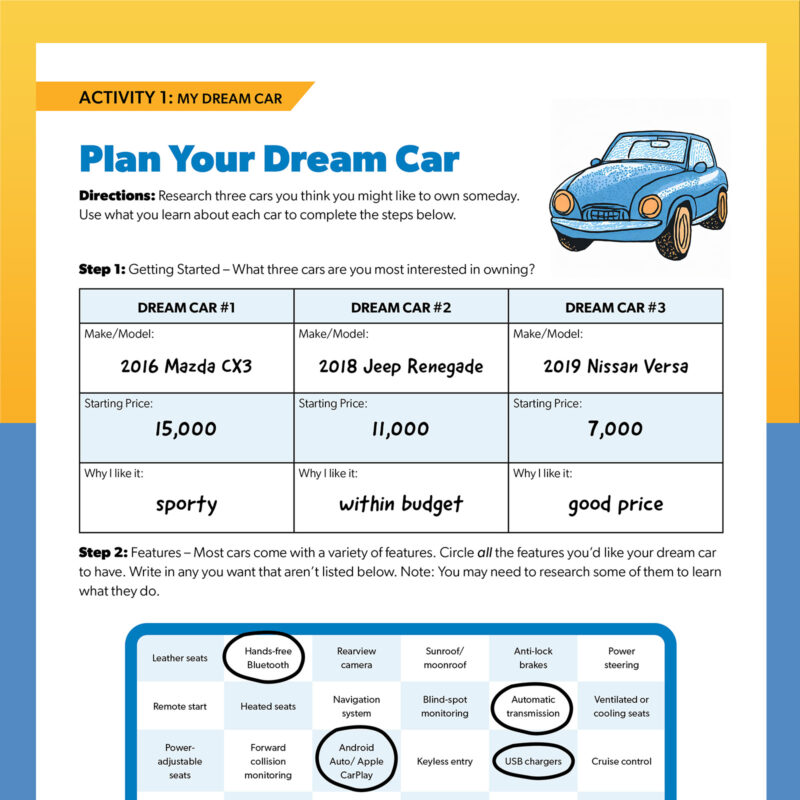

Activities 2 and 3: Comparison Shopping and Building a Budget

In “Comparison Shopping,” students will dive into the world of car shopping by selecting three vehicles that fit their needs. They’ll choose which features are truly essential in their first car, and which ones they can live without. Then comes the fun part: deciding which one is the perfect match and why. Once that’s settled, it’s time to crunch some numbers. In “Building a Budget,” students will figure out how much they need to save to buy their car. Additionally, they’ll determine how long it’ll take to reach their goal.

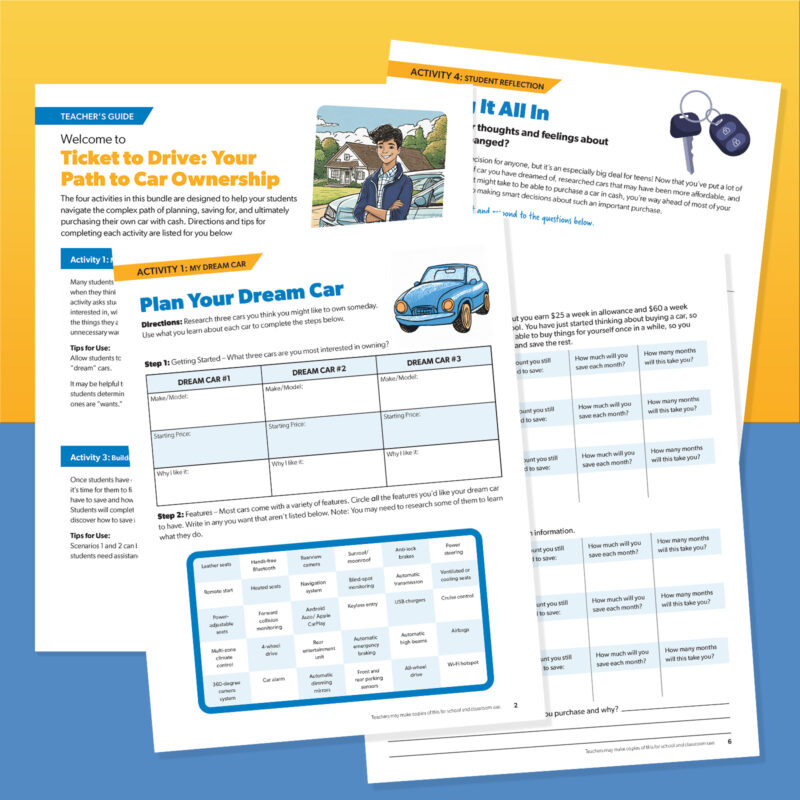

Activity 4: Student Reflection

After completing Activities 1 through 3, students will have the chance to reflect on their newfound knowledge. The questions are perfect as a take-home assignment or as a tool to assist with a post-activity group discussion. This activity provides a great opportunity for students to realize that they can approach this huge financial milestone with confidence.

Keep the financial literacy learning going with great resources

Our students want to learn about practical ways they can improve their lives after leaving high school. A strong financial literacy program that focuses on real-life applications can leave our students feeling empowered instead of anxious about their financial future. Check out Ramsey Education’s Foundations in Personal Finance curriculum to learn more about their life-application approach to financial literacy.