Money matters and financial literacy pays off in the long run! Teaching students how to make wise financial decisions is truly the gift that keeps on giving. Give kids a lifetime of economic know-how, which often translates to personal financial well-being, with these free apps and online resources that promote financial literacy.

Online Financial Literacy Resources for Grades K-5

Peter Pig’s Money Counter

Peter Pig makes learning about money fun thanks to this interactive game that teaches kids how to count and save money. After completing the game, players are rewarded with a trip to the virtual store. They can buy accessories within budget so they can dress up Peter Pig in fun costumes and accessories.

Wise Pockets

Wise Pockets is a financially savvy koala that hosts this interactive, online game. Kids learn the basics of budgeting and managing money.

Tooth Fairy Calculator

How much will the Tooth Fairy leave under your pillow? This special calculator tracks the fairy’s finances.

Fruit Shoot Coins

Add the necessary coins to match the total then shoot the fruit on this fun online game that strengthens counting skills.

Counting with Coins

Teach your students how to count with coins using this fun free online game sponsored by the U.S. Mint. Counting With Coins teaches basic math concepts and coin identification for grades K-2 in a fun grocery store setting.

My Classroom Economy

Easily customizable by grade level, My Classroom Economy allows students to learn by building their very own classroom “country”. Kids earn school “dollars” so that they can rent their own desks and face other real-world financial scenarios. This way, they can see first hand how individual and collective choices impact the economy.

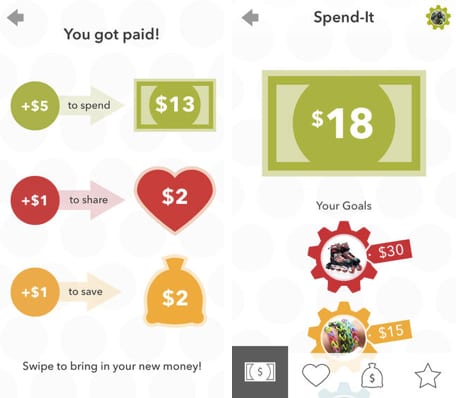

PiggyBot

It’s never too early to get kids talking about smart spending and saving. PiggyBot is a learning app that helps set goals, assign chores and keep track of IOUs.

Hands on Banking / El futuro en tus manos

The elementary school modules of this free, bilingual, financial education program show kids where money comes from. Plus, it teachers how they can best use money, and how banks help keep it safe.

Time for Kids

A powerful teaching tool, TIME for Kids builds reading and writing skills and now financial literacy! Their monthly magazine—Your $—brings financial education to fourth, fifth, and sixth graders across the country in a fun and engaging way.

Online Financial Literacy Resources for Grades 6-12

MoneyMath: Lessons for Life

Designed by the U.S. Department of the Treasury for middle school teachers. Money Math features downloadable student lessons on a variety of financial topics, including taxes, budgeting and even includes instructions on how to become a millionaire.

Financial Football

Visa and the National Football League have teamed up to create Financial Football. This fast-paced, interactive game requires players to answer personal finance questions to score points. Plus, teachers can incorporate the supporting lesson plans. Don’t like football? Check out Financial Soccer.

Lunch Tracker

What are you spending on lunch? Kids will be surprised to see how much they can save with simple cost-cutting measures. Calculate your spending, learn cost-cutting tips, and save money.

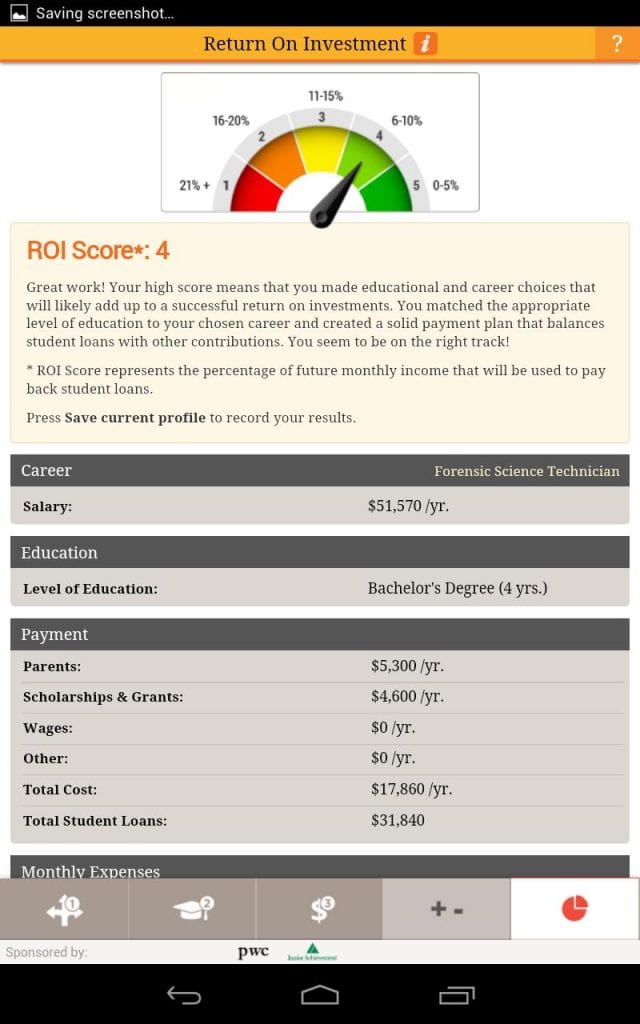

Build Your Future

Teens feeling foggy about their financial futures will want to check out this app! First, students explore more than 100 careers. Then, after answering a series of questions, teens are given a Return on Investment (ROI) score between 1 and 5. The number showcases whether or not they can easily pay off their debt with future income.

Gen I Revolution: Online Personal Finance Game

Developed for middle school and high school students, this online game gives students the chance to learn important personal finance skills as they play and compete against fellow classmates.

Chair The Fed Game

Learn how monetary policy works by taking charge of a simulated economy.

Plan’it Prom App

Between glam gowns and long limousines, prom can cost hundreds of dollars these days. Visa’s free app helps teens and parents budget for every prom-related expense.

Stock Market Game

Play the market (without having to worry about losing it all) with the Stock Market Game. Not only does this tool help students build a fundamental understanding of investing, it also provides them with real-world skills practice in math.

Take Charge Today

Take Charge Today offers more than 75 lesson plans designed, tested, and edited in collaboration with university researchers, financial industry experts and classroom educators.

MoneySKILL

This free, interactive, reality-based online curriculum educates students in middle and high school on the basic understanding of money management fundamentals.

EVERFI

EVERFI helps teachers, schools, and districts bring real-world money management skills to students. The interactive digital platform has over 100+ interactive, game-based lessons for teachers to better engage students.

NEFE’s High School Financial Planning Program® (HSFPP)

NEFE’s High School Financial Planning Program® (HSFPP) guides students through tasks so that they can apply financial decisions to their own lives and return in the future to do it again successfully.

Are we missing any online financial literacy resources? Share in the comments below!

Plus, 5 Ways to Integrate Money Skills Across Curriculum.