It’s a sad reality: Many of today’s students don’t have the financial literacy they need to navigate the modern world. Yet my middle school students want to know how they can achieve their goals—whether it’s saving for a new phone or for college.

Luckily, the MassMutual Foundation and EVERFI have created an amazing financial education program for middle school and high school students, free of charge. As a seventh and eighth grade AVID* teacher, one of my responsibilities is to teach my students real-world skills to be successful. For me, that means teaching them how to manage their finances, make sound decisions, and become financially responsible. I’ve been using FutureSmart from EVERFI for years—it’s become the go-to resource I lean on.

Here are my favorite reasons why I enthusiastically refer to FutureSmart as “Wealth Management 101.”

It’s totally free.

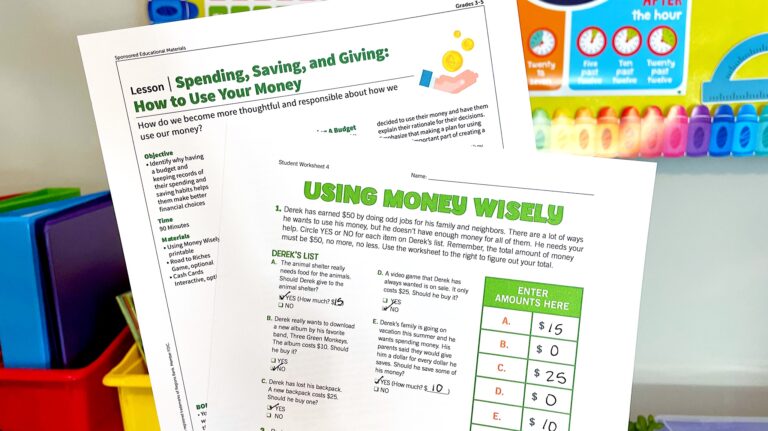

I’ve found that free curriculum is often flawed, but that couldn’t be further from the truth with FutureSmart. The story-based narrative and interactive exercises help kids learn to make real-life decisions about their personal finances. They also teach them how to achieve important goals around saving money, education and career planning, and budgeting. Not only that, I know I can reach out for tech support with questions about the lessons at any time. This is definitely above and beyond what you might expect from a free platform.

It’s easy to get started.

The FutureSmart content and lesson plans are all there, ready to be used! After you set up your teacher account, simply create a class list and share an access code with your students. I use an easy-to-remember system for student usernames and passwords, so logging in is never an issue. My students and I access the EVERFI app right from the district portal, which makes it easier than ever to sign in and get going.

It fits into my curriculum.

FutureSmart takes about 45 minutes, but because it is self-paced, students finish levels at different points. It has seven levels, so I task my students to pass one level each time they play. The students who pass all seven levels get “certified.” They love printing and showing off their certificate. Even better, EVERFI tracks and organizes each student’s scores by class in a report, so it’s easy for me to monitor.

In addition to the FutureSmart course, there is a suite of offline lessons and supplemental videos available on my teacher dashboard, as well as additional parent and teacher resources available from the MassMutual Educators and Families portals, including the option to become a “FutureSmart Certified” educator.

Honestly, like so many other teachers, I have realized how incredibly important it is to support students’ social-emotional well-being, and FutureSmart has been a great fit. The real-world scenarios and engaging lessons help my students think about and look forward to the future.

Kids love the pace of personalized learning.

Students have the freedom to access the curriculum in their own way. For schools that are virtual or hybrid, this has been particularly important. Once students complete the first FutureSmart module, “Welcome Mayor,” they are free to tackle any of the remaining six levels in any order they wish. Some students choose “Growing a Business” because they want to see if they have what it takes to run their own business venture. Others are curious about “Smart Shopping,” in which they help a character follow a budget as he picks out things for his bedroom. The “Build Your Blueprint” level is the ultimate because my students can design a plan around their aspirations and match their talents with a career. A good curriculum lets students explore their dreams and also make mistakes.

I don’t need to police my students while they are online.

My students are very familiar with the program, and they enjoy it so much. It’s visually appealing, age-appropriate, and challenging enough to keep them hooked. Because I loop with seventh and eighth graders, I’m able to form strong relationships with them, and I trust they’re doing the work, even when I’m not walking around the room monitoring.

I’ve seen a ripple effect in the lives of my students.

My students are not only learning about financial management, they’re making the connection between money and real life. The lessons my students are learning from FutureSmart have given them a greater understanding of the financial decisions their parents may be facing. Many of them share with me that they had no idea about and have a greater appreciation for all that their parents do. As teachers, we have the responsibility, now more than ever, to provide this knowledge to our students because they are living it.

It gives my students the language to confidently grow their financial skills.

One of the biggest takeaways for my students is mastering the lingo of money. Before my students embark on a level, I front-load vocabulary instruction. This strengthens their retention of the concepts. For example, in “Ways to Pay,” my students learn the difference between interest on a credit card versus using a debit card. I’ve seen firsthand how giving students command of language in the realm of finance is empowering.

It can even help my students earn money for college.

One of the things I’ve been focusing on lately is motivating my students to start planning for college. The MassMutual Foundation offers a FutureSmart contest that rewards students with up to $5,000 in a 529 college savings gift card. It is open to any U.S. student in grades 6–8. And all you have to do is complete at least three FutureSmart digital lessons and share what you learned. This gives my students even more motivation to participate in something they already love.

It feels good knowing this will help them for years to come.

This is the fourth year I will be using FutureSmart, and I can honestly say it has empowered all of my students with the knowledge that they need to handle financial decisions in their lives. With many states now requiring personal finance courses to graduate from high school, it also prepares them for the next step in their educational journey. It feels good that I am supporting learning that is going to make a difference. One day they will remember one of the lessons, and it might save them money or stress. As corny as it sounds, that kind of impact reminds me why I teach.

*Advancement Via Individual Determination: A readiness program designed to help students develop the skills they need to be successful in college and in real life.