If you’re a teacher, principal, or counselor, you’ll want to claim your Educator Expense Deduction for 2023 on your tax return. The good news is that the permissible deduction amount increased in 2022. So, what is the educator expense deduction and what can teachers deduct?

What is the Educator Expense Deduction?

According to the IRS, eligible teachers can deduct up to $300 ($600 if married to another teacher and you are filing jointly) of unreimbursed “unrelated trade or business expenses” on your tax return for 2023. The teacher deduction increased from $250 to $300 in 2022, though many want to see it increased further.

Who can claim the deduction?

An “eligible teacher” is anyone who taught kindergarten through 12th grade or worked in a school (counselor, principal, aide) for at least 900 hours a school year in a school that provides education under state law.

What is covered?

Anything that you paid or an expense you incurred for:

- Participation in professional development

- Books

- Supplies

- Technology (computer, software)

- Equipment, including athletic equipment for P.E. teachers

- Supplementary materials for the classroom

More recently included, expenses for personal protective equipment, disinfectant, and other supplies related to protection against COVID are deductible.

Also eligible are:

- Interest on series EE and I U.S. savings bonds that you exclude from income because you paid higher education expenses

- Distribution from a qualified state tuition program that you exclude from income

- Tax-free withdrawals from a Coverdell education savings account

- Reimbursements that you receive for expenses not reported in box 1 of the W-2 form

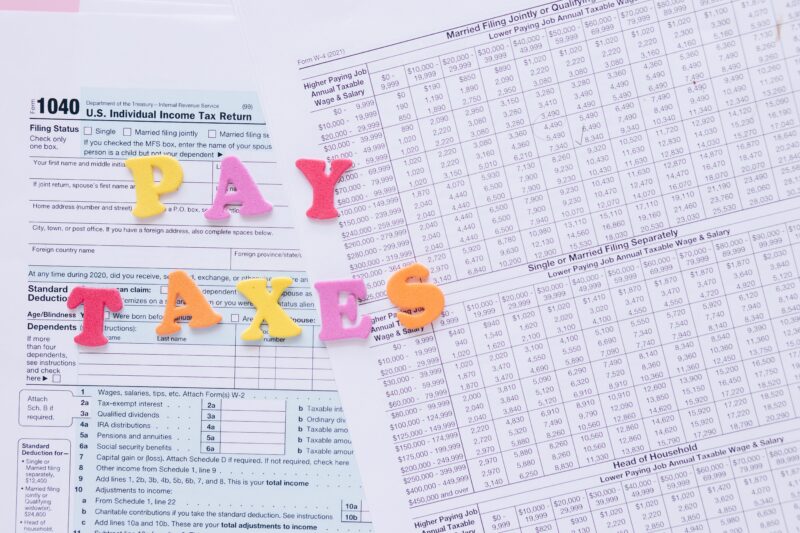

How do I take the Educator Expense Deduction for 2023 taxes?

You include it in your tax filing on whichever form you use (1040, 1040SR, etc.). The deduction reduces your amount of taxable income, which in turn reduces the taxes that you owe.

During the year, you should keep track of expenses by keeping receipts and staying organized so you have all receipts in a separate file, and/or record all your expenses in a file or folder so you have them easily on hand when it’s time to do taxes.

Read more: Best Tax Savings Strategies for Teachers

Is a $300 tax deduction enough?

Short answer: No! Three hundred dollars is a drop in the bucket for many teachers when they’re tallying what they spend on their classroom each year.

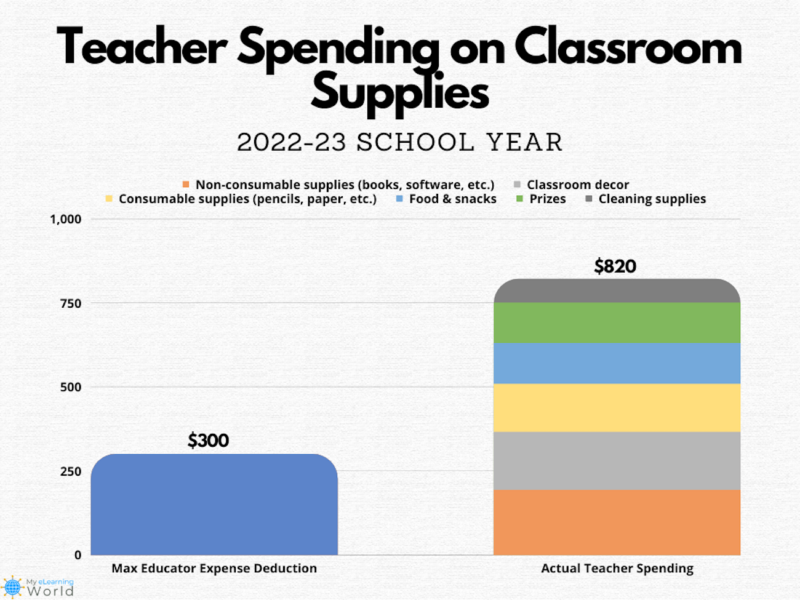

According to a survey of teachers by the Association of American Educators, teachers spend an average of $673 of their own money on their classrooms each year.

Many teachers know they are going to spend more than the minimum. In the 2022-2023 school year, teachers anticipated spending $560 of their own money on their classrooms, and 17% said they anticipated spending $1,000 on their classrooms.

The bottom line is that $300 is not a lot of money, and across those 900 hours of teaching, the expenses—snacks, books, supplies—add up fast.

Read more: Why Is the Teacher Tax Deduction So Much Less Than What We Actually Spend?

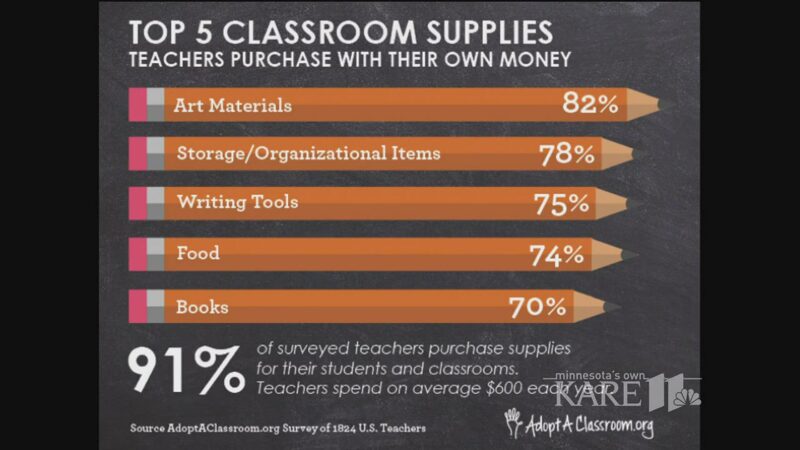

What do teachers actually spend money on?

NEA Today asked teachers what they spent money on and it included everything from basic school supplies (pencils, paper, notebooks, binders, clipboards) to fans for non-air-conditioned classrooms and snacks for hungry students. More than 90% of teachers reported that they spend their own money on school supplies and other materials their students need, from books to online subscriptions.

Check it out: All the tax credits and deductions you should know about at tax time.

If you’re married to another teacher, read this article before doing your taxes.

What teacher expenses do you deduct on your tax return? Is $300 enough? Come and share in our We Are Teachers HELPLINE group on Facebook.